QUEZON CITY, December 1, 2021 – The Department of Agriculture (DA), the Fertilizer and Pesticide Authority (FPA) and the Fertilizer Industry Association of the Philippines (FIAP) convened via zoom virtual meeting on November 17, 2021 to tackle rising fertilizer prices. FIAP is an association composed of 19 fertilizer manufacturing and importing companies.

The meeting was led by DA Secretary William Dar with the assistance of FPA Executive Director Wilfredo Roldan. Also present from DA are Engr. Ariel Cayanan, Undersecretary for Operations and Agri-fisheries Mechanization; and Dr. Leocadio Sebastian, Chief of Staff.

Recent updates provided by the fertilizer industry highlights how situation in the European Region, China, and other producing countries drive global fertilizer prices.

Factors influencing global fertilizer situation price trend

World fertilizer market situation

Mr. Nilo Arteche Cabrera of FIAP presented the world fertilizer market situation. He cited that the COVID 19 pandemic brought significant impact to the price trend as each country tried to secure domestic food production by increasing their crop areas. For instance, big countries like India, Australia, and Brazil have increased fertilizer demand than their pre-pandemic requirement.

He added that the recent gas shortage in Europe made domestic fertilizer manufacturers to cut production due to hike in energy prices. The region now has to compete in the global fertilizer demand. Fertilizer prices in North Africa (Egypt) and the Middle East prices have been also moving upward.

China curtails fertilizer exports

With the rise in energy prices, fertilizer manufacturers in China cut their energy use. The Chinese government also made the decision to reduce carbon emission in preparation to their hosting of 2022 Winter Olympic Games. Reduced energy and carbon use now means reduced fertilizer production of the country.

Moreover, with the implementation of the China Inspection and Quarantine (CIQ) policy, fertilizer exports were curtailed due to complex procedures and strict measures for export cargoes. Urea, DAP, MOP, NPK and other fertilizer grades are among the items covered by the CIQ policy.In addition, China has to secure its domestic requirement first.

South Korea immediately felt the impact of said Chinese policy. Now, it has to source out its urea demand to other countries at higher prices. Urea is vital to the country for it is being used as fuel to diesel cars and cargo trucks.

Price increase of fertilizer grades

The FIAP explained the reason behind the price increase of various fertilizer grades, citing HeartyChem Corporation as their data source:

- Urea (nitrogen)- The hike in urea prices started from Europe and aggravated by the China restrictions for cargo exports until it was felt all over the world. For instance, Korea is buying it close to USD1,000/MT Cost FR FO in bulk. It was USD230-240/MT CFR at the beginning of 2021.

- DAP (di-ammonium phosphate) – Due to China CIQ policy, DAP prices started to soar with fixing price now moving close to USD1,000/MT in bulk from USD600/MT CFR in Korea last September 2021. For the fourth quarter, India recorded price of Phosphoric Acid at USD1,330/MT CFR in bulk from the USD170/MT in the third quarter.

- MOP (muriate of potash) – Large volumes of imports from Brazil and the increased demand in Belarus affected global MOP prices. At the beginning of 2021, it was USD230-240/MT CFR, but it is now close to USD700/MT CFR.

- NP/NPK (nitrogen and phosphorous/complete) – With the soar in raw material prices’, NP/NPK prices are moving upward continuously. This increase has been propelled mainly by the Chinese export policy on legal inspection. With ceased China NP/NPK exports, other producers in the world are moving up the prices along with increasing feedstock prices.

Cabrera expressed that today’s fertilizer crisis is different from the 2008 crisis which was more financial in context. The status quo is more complex which is interlinked to the problems brought by the pandemic, issues on food security, energy shortage, and monopoly and control of powerful countries when it comes to trading.

Comparative import data from 2018-2021

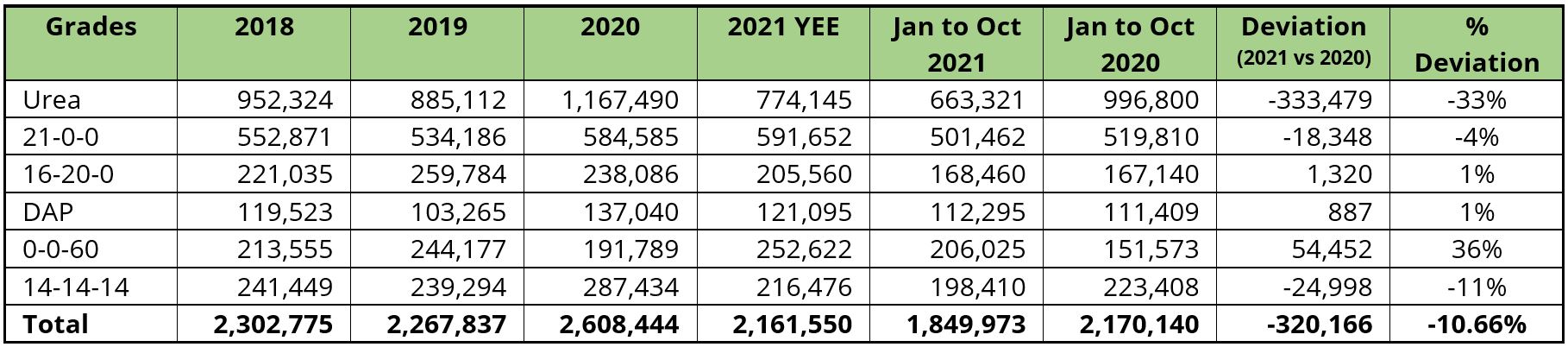

Michael Ardieta, FIAP President, presented (Table 1) the comparative import data from January 2018 to October 2021 in metric tons (MT). A notable increase in fertilizer imports can be observed in 2020 which was due to government’s implementation of the fertilizer subsidy program. The 775,145 MT year-end forecast for 2021 was lesser compared to 2018 and 2019 data, but this could also be the spill over of supply from year 2020.

Table 1. Comparative import data of the six-major fertilizer grades from January 2018 to October 2021 (MT)

Next steps

Moving forward, Sec. Dar expressed that the country could utilize government to government relations with China and other countries to address prevailing issues. China serves as the major source of Philippines fertilizer imports due to lower cost than other producing countries such as Vietnam, Qatar, Indonesia, Malaysia.

The Secretary also shared that this could be just like what the Embassy of Iran did when they expressed willingness to a Mutual Agricultural Cooperation with the country, which includes exportation of fertilizers. He advised the FIAP to coordinate with FPA and present their proposed government actions. Agreements shall be endorsed by the FPA and DA to the Office of the President for him to have informed-decision on the matter. ###

Writers:

Wildredo Roldan, FPA Director

Myer Mula, SAAD Director and FPA Deputy Director for Fertilizer

Comments (0)